How to Draft a Business Budget

During the Covid-19 Pandemic

See also: Business Survival During a Pandemic

There has recently been an understandably heightened emphasis on budgeting, expense management, and financial planning. The unique circumstances of the coronavirus pandemic have forced businesses to examine and prioritize what to spend money on.

Budgeting is fundamental for any successful business. Budgeting is a particularly crucial skill during a unique period where revenues are plummeting, profits are evaporating, and sales are drying up.

Proper budgeting can reposition your business and allow you to adapt to even the most critical of conditions.

This article details basic budgeting considerations and frameworks to help you reorient your processes, optimize your operations, and minimize your risks.

Defining Budgeting

The Small Business Administration (SBA) defines budgeting as a way to establish operation costs, funds for labor or materials, and necessary revenues.

In other words, budgeting helps you determine what resources you have, the amount you can and should spend, and how much you need to bring in to maintain operations.

Drafting a budgeting, however, isn’t just about money or micromanaging corporate finances. It also encompasses how businesses prioritize projects and define process improvements.

Another thing to keep in mind is that budgeting looks different for startups and small businesses than it does for well-established businesses.

For instance, a startup may be more comfortable budgeting on a quarterly basis since they may have limited data to use in forecasts. On the other hand, more established businesses may rely on historical data or past experiences to determine critical benchmarks.

Use this framework to budget during this time of crisis.

Assess Your Bandwidth

It’s best to take a tailored approach to your budget by considering the unique characteristics of your industry.

Perform market and competitive analysis to understand how industry competitors are faring during the crisis. This insight can inform how you project revenues in this unorthodox time.

Once you arrive at a basic estimation of revenues, budget your costs and expenses accordingly.

Costs generally fall under three categories:

Fixed: Costs stay the same, regardless of revenue, for example, rent or insurance.

Variable: Costs vary by business or sales volume. For instance, the cost for materials change depending on business activity.

Semi-variable: Combination of fixed and variable costs, for example, commission payments.

Variable and semi-variable costs depend on business health, which is why it’s important to make an informed projection of your revenues before budgeting your costs. Without revenue to fuel certain variable or semi-variable costs, you probably won’t incur them. For example, sales commissions will be lower with lower sales.

Prioritize Your Projects

During a crisis, your business needs to narrow down the initiatives that are most worthwhile.

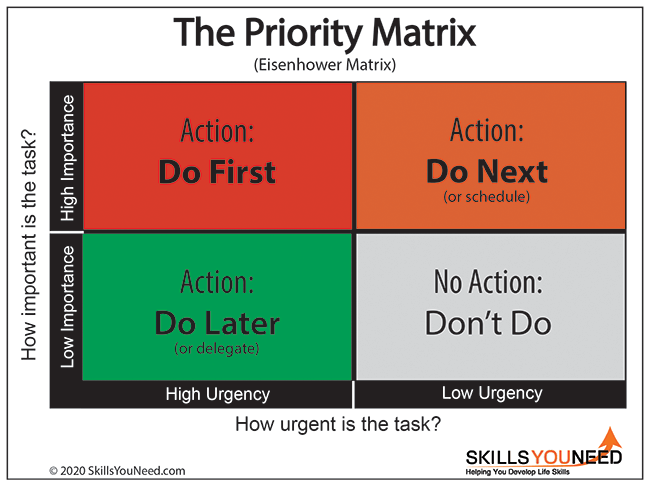

The Priority Matrix is one framework your business can rely on to determine your its top priorities.

In a priority matrix, projects are identified as important or urgent. Important projects bring value to your business and lead you towards your overall mission. Urgent projects call for immediate attention and insist on action.

See Time Management for more.

When a project shares both of these characteristics, it signals it is important to your business’ core operations.

Note that important, non-urgent tasks take priority over urgent, unimportant tasks. Importance, then, takes precedence over urgency.

In times like these, it’s especially important to support the processes and projects that are the most instrumental to your business. Following this framework, you can then triage down to less important tasks.

For example, if you are choosing between budgeting for graphic design and PPC advertising, review which is most important to making your business run.

If PPC advertising directly corresponds to revenue, it is more important than graphic design, thus should be budgeted for.

Naturally, forgoing a project is easier said than done. Saying “no” to certain projects, despite their appeal, enjoyment, or small chance of high reward, is central to your ability to commit to projects that matter most.

Use Your Limited Budget to “Make Lemonade”

It’s possible to find a silver lining even in darker times. For example, these unusual circumstances provide a valuable opportunity to reexamine your projects, implement process improvements, and invest in upskilling or retraining employees.

When you refocus business priorities on singular and important processes, it can lead to staffing imbalance – for example, you have members of the marketing team who don’t need to focus on marketing given its budget cuts.

While this may seem uncomfortable at first, it can be an exciting chance for employees to get exposure to new projects outside of their usual scope of work. Consider dedicating small portions of your reallocated budget to train your existing employees on new projects.

Most employees expect their businesses to provide job development opportunities. For example, marketing employees can learn to conduct sales calls and outreach.

What’s more, a sense of variety can keep your team energized and motivated: alternating between smaller and larger projects can preserve team energy and team morale during a trying environment.

Rely on the Right Resources

Another silver lining: you’re not alone! There are various tools and resources that can lighten your load as you decide on which projects to direct budget towards.

Microsoft, for example, offers free budget templates that can help you manage your business finances.

If you are hesitant to install or maintain accounting software, research financial planners or accountants to help you draft a budget.

Remember the Benefits of Planning Ahead

Budgeting can feel like a burden. However, it is helpful to keep in mind that creating a budget can only help your business. One framework to view budgeting is as a tool to best orient your business towards success.

By maintaining the right mindset, you can make better spending decisions and improve your operations—even in the most difficult of times.

Further Reading from Skills You Need

The Skills You Need Guide to Business Strategy and Analysis

Based on our popular management and analysis content the Skills You Need Guide to Business Strategy and Analysis is a straightforward and practical guide to business analysis.

This eBook is designed to give you the skills to help you understand your business, your market and your competitors.

It will help you understand why business analysis is important for strategy—and then enable you to use analytical tools effectively to position your business.

About the Author

Emily Landkamer is an Editorial Associate for Clutch, a data and insight-driven research, ratings, and reviews platform for B2B services. Using Clutch, businesses can vet and make an informed decision about the best services partner for their project needs.

Continue to:

Budgeting

Strategic Thinking Skills