The Boston Matrix and

The Ansoff Matrix

See also:Strategic Thinking

The Boston Matrix and the Ansoff Matrix are both marketing tools designed to help companies explore their product portfolios and strategies, and make decisions about where to focus attention.

The Boston Matrix was developed by consultants at the Boston Consulting Group in the 1970s, and is also known as the Product Portfolio Matrix. It is designed to help companies work out which of their products are worth attention, which should be stopped, and what strategies to use to improve sales.

The Ansoff Matrix, also known as the Product/Market Expansion Grid, was developed by Igor Ansoff and first published in the 1950s. It focuses on the possible strategies for growth, and the risks associated with each one.

While both these tools are relatively old, they still have their uses in strategic decision-making.

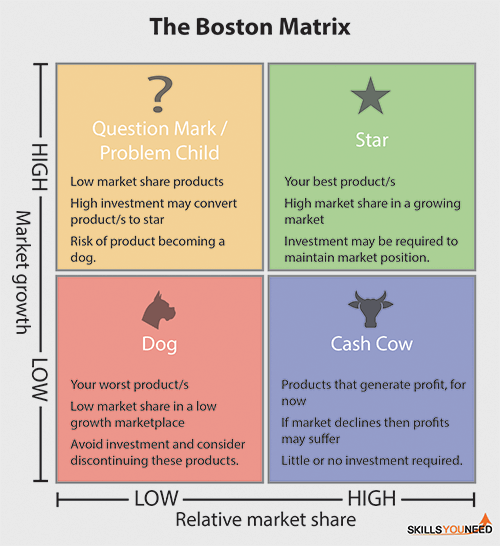

The Boston Matrix

The Boston Matrix assesses each product on two measures:

- Relative market share. The product’s market share compared to its competitor products, which gives a measure of cash generation; and

- Market growth: how much the market itself is growing, which gives a measure of cash usage.

You can work out each one exactly, or you can just opt for a low–high distinction.

Each product is plotted on a simple four-by-four grid with relative market share and market growth as the axes (see diagram below), giving four possible product categories.

These are:

Stars

These are the best products: they have a high market share of a growing market, so will hopefully continue to generate cash and profits for a long time. They may eventually become cash cows, when the market stops growing. These products may require investment to sustain their market-leading position.

Problem children/Question marks

These products have a relatively low share of a high growth market. They therefore tend to absorb a lot of attention and money as the business attempts to convert them into stars by increasing market share. They can, however, fall into the ‘dogs’ category if the market growth slows before the necessary market share has been achieved, and therefore do need careful watching.

Cash cows

These products need very little attention, and simply generate profits. In many cases, they are a good source of the resources to try to convert problem children into stars. However, a market that is not growing may easily be declining, and these products may not continue to generate profits for ever.

Dogs

These products have a low share of a low-growth market. They are therefore not worth bothering about, and products falling into this category should, ideally, be discontinued as soon as possible unless they are generating reasonable returns for little input. It is important to avoid spending money on these products.

As with any tool, there are issues with the Boston Matrix. For example, it was designed for use with products, and although it can also be used for services, this may take care. It is also relatively simplistic, which is both a strength and a weakness. Used in conjunction with other tools, such as the Ansoff Matrix, however, it can be helpful aide to decision-making about product futures.

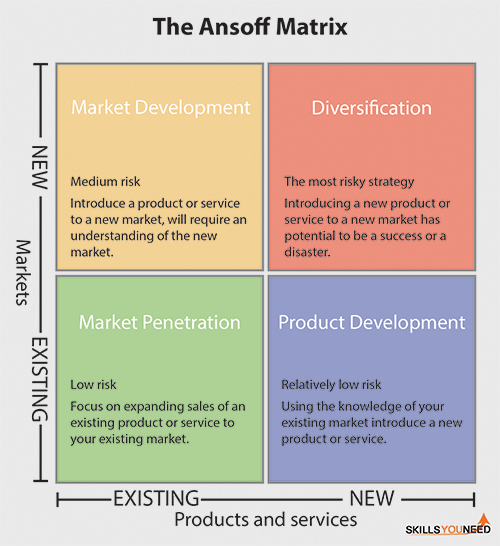

The Ansoff Matrix

The Ansoff Matrix is also known as the Product/Market Expansion Grid.

The Ansoff Matrix plots products and services against the markets in which they are sold or marketed, on the basis of whether they are new or old (see diagram), and therefore identifies four possible strategies for growth.

Using the Ansoff Matrix

Each square in the matrix represents a different strategy, with risk increasing with each step upwards or to the right. The four strategies are:

Market Penetration

Market penetration is the least risky strategy, focusing on expanding sales of an existing product in an existing market. It can, however, be a bit limiting, both in terms of market size, and the possible sales of your product or service.

Product Development

The next option is product development, where you introduce a new product to your existing market.

This is less risky than moving into new markets because you (should) understand your market quite well, and therefore know what will sell. You can generate a new product by providing an add-on or a variant to an existing product.

Market Development

As an alternative, you may want to move your existing product into new markets, a strategy of market development. This is more risky, because you have to develop an understanding of a completely new market. It can be done by finding new uses for an existing product, for example.

Diversification

Diversification is the most risky strategy of all, because it involves introducing a new product into a new market. You therefore have no idea whether the product will sell, and no experience of the market in which you are introducing it. This strategy can generate big rewards, but it can also be a disaster, and you need a coherent risk management strategy in place.

All these strategies have some elements of risk about them, and for more about how to manage this, you may want to read our page on Risk Management.

Further Reading from Skills You Need

The Skills You Need Guide to Business Strategy and Analysis

Based on our popular management and analysis content the Skills You Need Guide to Business Strategy and Analysis is a straightforward and practical guide to business analysis.

This eBook is designed to give you the skills to help you understand your business, your market and your competitors.

It will help you understand why business analysis is important for strategy—and then enable you to use analytical tools effectively to position your business.

Tools for the job

The Boston and Ansoff Matrix offer ways to look at products and markets, and decide on a future strategy for growth if necessary.

The Boston Matrix focuses on products, and the Ansoff Matrix adds in the market as well. Taken together, they can provide a useful support for decision-making.

Both, however, have some limitations, particularly their simplicity.

Decisions should be made with care, and should feel right for the business too.