6 Reasons to Consider a Career

in the Insurance Industry

See also: Careers in Insurance and Banking

Like other verticals, the insurance industry is seeing shifts from the migration of Baby Boomers in the workforce, technological advancement and talent gaps.

February is Insurance Careers Month, a time to celebrate the industry and inspire young professionals to consider a stable and rewarding career path with an insurance organization.

For new job seekers, or those looking for a career change, an insurance-related role might not be your first thought. Only 4% of millennials are interested in working in the insurance industry due to a negative perception and lack of knowledge about the field, according to Deloitte.

However, the industry is vast, diverse, growing and exciting. As an insurance industry veteran and executive, I’m fortunate to have a bird’s-eye view of the burgeoning space. In a landscape where everyone wants to work for the next unicorn startup, there’s something to be said for a historically stable and growing industry.

Here are six reasons why you should consider working within the insurance industry.

1. Opportunities for All Skill Sets and Backgrounds

The wide scope of the insurance field means there are positions for a variety of interests, skill sets and experience. No matter your educational or professional background, there’s likely a path within the insurance industry for you. For example, roles for an insurance company can include:

- Accounting

- Data analysis and data science

- Actuarial science

- Risk management

- Business operations

- Administration

- Sales

- Customer service

- Human resources

- Legal

- Marketing

- Medical, including clinical

- Product development

- Software development and management

- Information technology

- Underwriting

2. Possibility for Professional Development

Within the insurance industry, you can advance in your career and learn new skills for professional development. The insurance field offers high levels of training, partially because employees must be knowledgeable on the latest regulations and industry standards. Also, managers are aware of talent gaps and hiring challenges; therefore, they focus on employee retention. As such, companies prioritize continuing education, workshops, seminars and webinars, as well as networking and mentorship.

3. Growing Demand and Increased Recruiting

If you choose to pursue an insurance-related career, you face better employment odds in an already favorable job seekers market. A recent survey of more than 50 insurance companies and 285,000 employees found that 92% of those businesses are hiring. Nearly half of the companies that are actively recruiting (43%) plan on hiring 51 or more employees. With a low national unemployment rate of 3.5% in the U.S., the rate within the insurance industry is even lower at 2.6%.

On a macro level, according to that same Deloitte report, Baby Boomers make up one-fourth of the insurance workforce and are nearing retirement age. This shift is expected to leave 400,000 unfilled jobs in the U.S. by the end of 2020, as well as “result in the loss of a wealth of institutional knowledge.” All signs point to an industry in need of fresh and hungry talent, with the open jobs (and payroll) to support it.

4. Industry Sustainability and Security

Health, auto, life, home, business—there are countless types of insurance, and people will always need them, making the industry incredibly sustainable. With some fields, you may worry that the economy or automation can impact your career. But insurance is always in high demand.

To use the actuarial position as an example, the U.S. Bureau of Labor Statistics (BLS) projects that it will grow 20% in the next 10 years, much higher than other occupations. Also, the number of insurance sales agents is expected to grow 10%.

5. New Innovations and Technologies Keep Your Job Interesting

The insurance industry is continuously and directly affected by technological advancements. Innovations like electronic scooters, driverless cars or even 3D printers require new strategies and policies due to potential risk. All these advancements within our society present unique challenges that insurance companies must solve via proper coverage for both individuals and businesses. If you want a career that evolves with technology and doesn’t get stale or boring, insurance can offer just that.

Insurance companies can offer dynamic new solutions to their target audiences. The Deloitte 2020 Insurance Outlook report confirms this: “Insurers are looking to bolster core systems, add capabilities, and enhance customer experience through artificial intelligence (AI), digitalization, new sales platforms, alternative product development, and other innovations. Many are beginning to pivot from investments to support business as usual to financing innovations facilitating more fundamental business model changes.”

6. Make a Tangible Difference in Other’s Lives

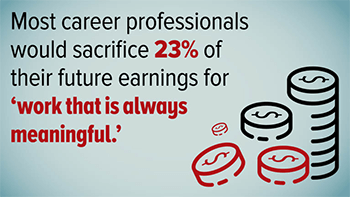

Image source: BetterUp Labs and SHRM

More than 9 out of 10 workers would trade a portion of their future salary for meaningful work, according to a survey by BetterUp. Meaningful work makes employees happier, more productive and harder working.

Helping people assess and protect themselves against future risk is quite meaningful and important work. No matter your role, working for an insurance organization guarantees that you’ll make a difference for others. Insurance is a service-driven industry. You provide resources and relief that support individuals and businesses in their time of need. Whether it’s a fender bender, medical operation or natural disaster, insurance companies and their employees help others recover from a crisis.

Further Reading from Skills You Need

The Skills You Need Guide to Getting a Job

Develop the skills you need to get that job.

This eBook is essential reading for potential job-seekers. Not only does it cover identifying your skills but also the mechanics of applying for a job, writing a CV or resume and attending interviews.

Consider a Career in the Insurance Industry

Stable doesn’t mean stale when it comes to the insurance field. During my time as CMO at HealthMarkets, we’ve created new platforms and solutions that revolutionize how individuals shop for health insurance. We’ve made waves in our space by hiring new talent and providing a dynamic and innovative workplace to keep them engaged.

Insurance caters to customers, clients or partners from all walks of life. Whether you want to help individual families, work in a high-level corporate environment or develop new technologies, there is a company in the insurance industry that can offer you that role. We’re on the precipice of a generational workforce shift, talent shortages and digital evolutions that makes the industry perfect for hungry new professionals. If you’re looking for a challenging, meaningful career path with plenty of room for growth, consider the insurance field.

About the Author

Michael Z. Stahl is the executive vice president and chief marketing officer of HealthMarkets, one of the largest independent health insurance agencies in the U.S. that distributes health, Medicare, life and supplemental insurance products from more than 200 insurance companies.

Stahl holds the chartered property casualty underwriter (CPCU), associate in insurance accounting and finance (AIAF) and associate in reinsurance (ARe) designations, and earned a Bachelor of Science in economics from The Wharton School at the University of Pennsylvania. He lives in Dallas with his wife and four children.